Hong Kong Property Market Update: Major Stamp Duty & Mortgage Policy Changes in the 2024/2025 Budget

The Hong Kong Government has introduced pivotal policy changes impacting property transactions and mortgage regulations as part of the 2024-2025 Budget, announced by Financial Secretary Paul Chan on February 28, 2024. These policy updates aim to stimulate the real estate market by reducing transaction costs and improving mortgage accessibility, ultimately making property ownership more attainable.

Stamp Duty Reforms: Hong Kong Removes Purchaser Stamp Duties on Residential Properties

To encourage property transactions, the Hong Kong Government has removed all purchaser stamp duty measures for residential properties.

- Buyer’s Stamp Duty (BSD): Previously applied to non-permanent residents, BSD has been removed.

- New Residential Stamp Duty (NRSD): Previously applicable to second-time homebuyers, NRSD has been eliminated.

- Special Stamp Duty (SSD): Homeowners are no longer required to pay SSD if they sell their property within two years of purchase.

These changes significantly reduce upfront costs for buyers, making property ownership more accessible.

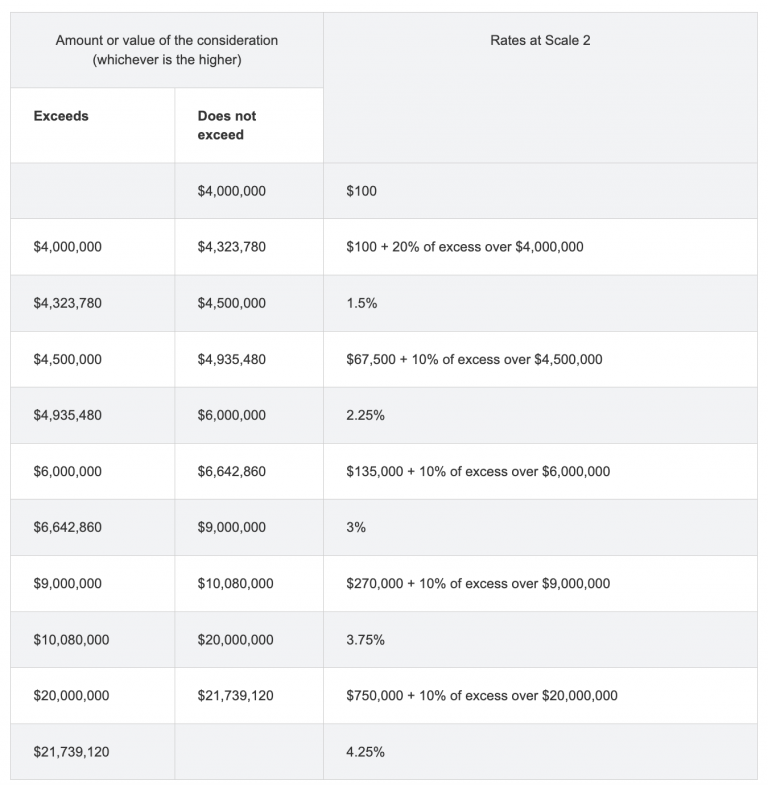

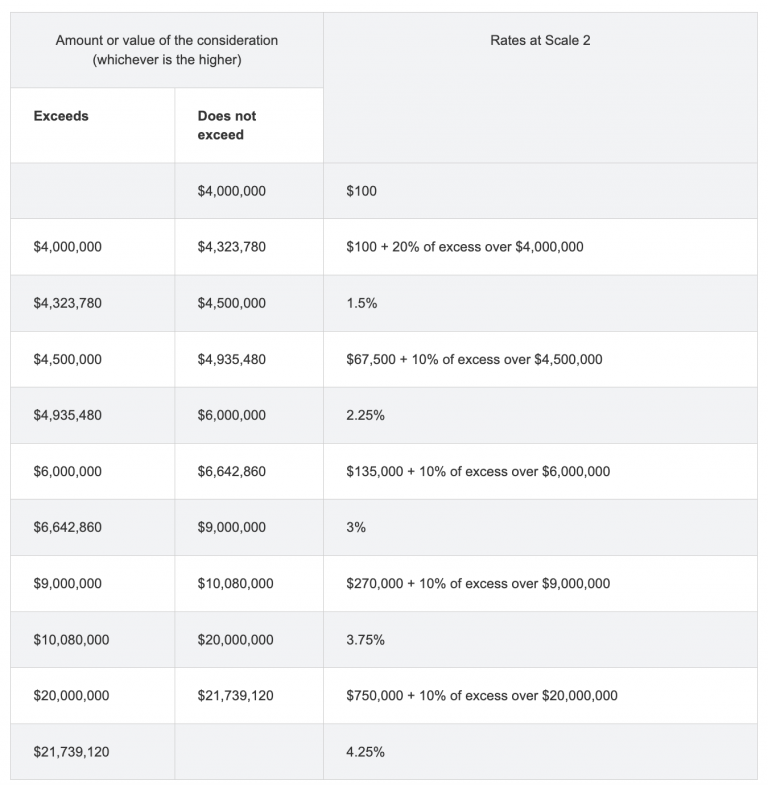

Current Stamp Duties in Hong Kong

Following the recent reforms, the primary stamp duty applicable to residential property transactions is:

- Ad Valorem Stamp Duty (AVD): This remains in place and is calculated on a sliding scale under Scale 2 rates, ranging from HK$100 for properties under HK$4 million to 4.25% for properties exceeding HK$21,739,120. AVD applies to permanent residents (PRs), non-PRs, and purchases registered under companies. Refer to the table below:

Changes to Mortgage Policies: Higher Loan-to-Value (LTV) Ratios

The Hong Kong Monetary Authority (HKMA) has adjusted mortgage financing regulations to improve accessibility:

- Higher Loan-to-Value (LTV) Ratios for Residential Properties:

- Properties valued at HK$30 million or below: Maximum LTV increased to 70%

- Properties valued between HK$30 million and HK$35 million: LTV will be adjusted gradually between 60-70%

- Properties valued at HK$35 million or above: Maximum LTV set at 60%

- Non-Self-Use Residential Properties: Maximum LTV increased to 60% across all price categories.

- Non-Residential Properties (Offices, Shops, Car Parking Spaces): Maximum LTV raised to 70%.

- Mortgage Stress Test Requirement Suspended: This change makes it easier for buyers to secure loans and finance their property purchases.

Key Takeaways

These policy changes mark a major shift in Hong Kong’s real estate landscape. With the removal of restrictive stamp duties and the relaxation of mortgage lending rules, both local and overseas buyers can now enter the market with greater confidence.